The Nigerian government has rejected Shell plan to sell its Nigeria onshore oil business to Renaissance Africa Energy Company Limited.

The Chief Executive Officer of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), Gbenga Komolafe, disclosed this while speaking at the launch of the project one million barrels of oil per day (mmbpd) initiative in Abuja on Monday.

Komolafe said the deal was rejected because it could not scale “regulatory test.”

In January, the Nigerian unit of London-based oil supermajor Shell Plc struck a deal with a consortium of five companies, setting the scene for the latter to acquire its onshore business in the country.

The deal was sealed after years-long setbacks met by the company in its efforts to cede ownership of the assets.

Shell Petroleum Development Company of Nigeria Limited (SPDC) will get up to $2.4 billion from the transaction including an initial sum of $1.3 billion. A further payment of $1.1 billion relating to prior receivables and cash balances is expected at the consummation of the deal, Shell said at the time.

The deal is a relief for Shell, which has sought to offload the assets since 2021 because running them has been complicated by sabotage, theft and spills, some of which have sparked litigations and environmental liabilities.

On Monday, Komolafe explained that out of the total of five divestment applications for consent received by the commission, four (representing 80 per cent) passed the regulatory test and secured ministerial consent.

He said divestment is an acknowledged practice and within the right of investors in business decisions globally.

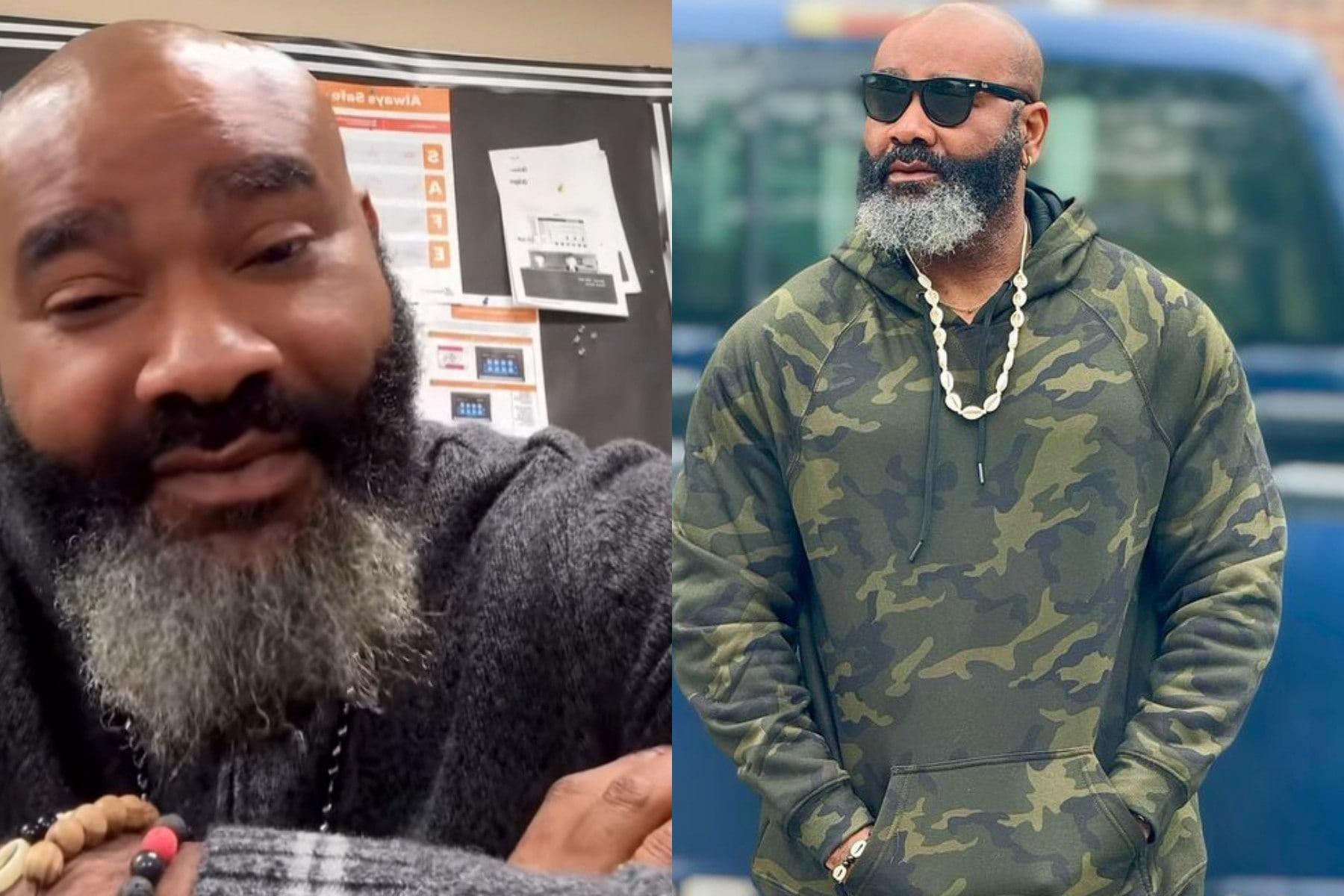

Managing Director of the Shell Petroleum Development Company and Country Chair, Shell Companies in Nigeria, Osagie Okunbor, who disclosed this at the just concluded 30th edition of the Nigerian Economic Summit explained that the company is concentrating more on the deepwater where it has significant technological and financial advantage.