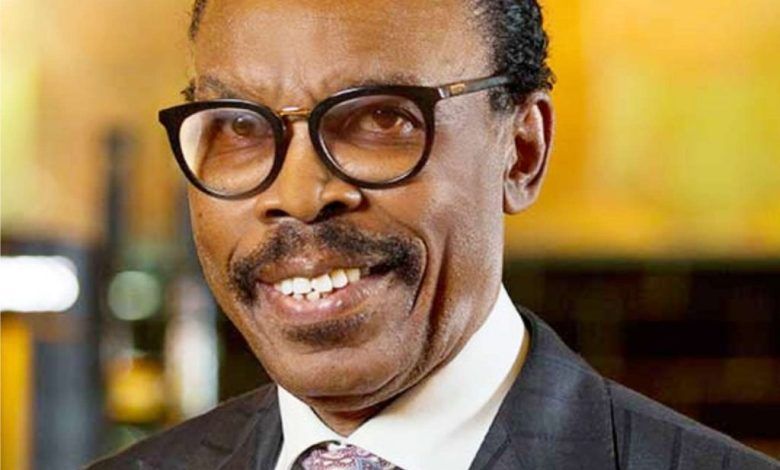

The Managing Director of Financial Derivatives Company Bismarck Rewane, has voiced strong support for the Central Bank of Nigeria’s (CBN) foreign exchange policies, stating that they are proving effective and helping align the naira closer to its fair value.

Speaking during a televised interview on Monday, Rewane praised the CBN for its interventions, noting that the naira has been strengthening in both the official and parallel markets. The currency closed Monday’s trading at 1503.63/$ at the Nigerian Foreign Exchange Market Window and 1,500.00/$ in the parallel market.

Rewane cited a Purchasing Power Parity (PPP) analysis, which pegged the fair value of the naira at 1,102.15/$, suggesting that the currency is currently undervalued by 26.35%. He emphasized that while attempts to protect an overvalued currency could distort market forces, supporting an undervalued currency helps to correct misalignments and bring it closer to its true value.

“What is the fair value of the naira? When you do the PPP analysis of the naira, it comes out at 1,102.15/$. In other words, the naira is 26.35% undervalued. If you intervene to protect an overvalued currency, that is bad, but if you intervene to support an undervalued currency, you’re actually bringing the currency back from its misalignment to its alignment,” Rewane explained, adding that the CBN’s actions in this regard deserve praise.

Rewane also pointed out several positive developments, noting that the difference between the official and parallel markets has shrunk to under one percent, compared to the 10-20% spread seen in the past. He attributed this efficiency to better market price discovery, where “Aboki FX” and shadowy figures are no longer blamed for discrepancies.

Additionally, he highlighted that Nigeria’s balance of trade had reached $18.6 billion, marking its highest level in years. This indicates that the country is importing less and exporting more, a shift partly driven by the exchange rate’s movement and policies aimed at discouraging imports while boosting exports.

Rewane also mentioned that the market now recognizes import substitution as a profitable venture, further solidifying the effectiveness of the CBN’s policies.

“The big picture is: are these policies working, and are they for the good of the country? In our humble opinion, the policies are working,” he concluded.