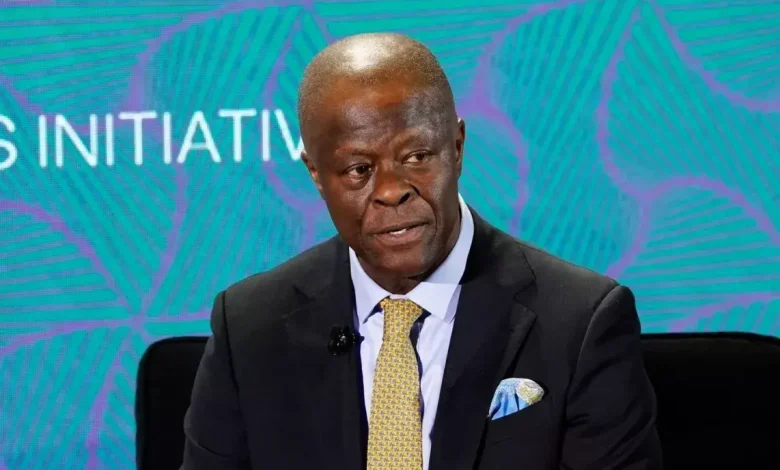

Nigeria’s Minister of Finance, Wale Edun, has confirmed that a forensic audit of the Nigerian National Petroleum Company Limited (NNPCL) is in progress, as the federal government intensifies efforts to boost transparency and accountability in the country’s oil sector.

Speaking at the Nigerian Investor Forum, held on the sidelines of the IMF/World Bank Spring Meetings in Washington, DC, Edun told global investors including representatives from J.P. Morgan and other international financial institutions that the audit is part of sweeping reforms designed to reset the economy and restore investor confidence.

“There’s a forensic audit of NNPCL underway so that we can really understand what has happened in the past,” Edun said.

The minister explained that, although the fuel subsidy was officially removed on May 29, 2023, the transition process created financial overlaps that need to be reconciled between the federal budget and the NNPCL’s books.

“Part of that burden shifted from the government’s budget to NNPCL. So, they have a legitimate claim, and they have some arrears that need to be given to them,” he noted.

“But then it’s a two-sided thing. There’s a reconciliation underway.”

Reform-Driven Growth Path

Edun reassured investors that Nigeria is laying a solid foundation for sustainable growth through a series of bold reforms. He said the administration is targeting 7% annual GDP growth, driven by investments in infrastructure, manufacturing, and agriculture.

“The most important thing is that NNPCL needs to come to the table with more oil production, more dollar revenue, and indeed, more revenue to the Federation. That’s the mandate they have been given, and I think they will deliver,” he said.

Leadership Overhaul at NNPCL

The audit follows a major shake-up in the leadership of the national oil company. On April 2, 2025, President Bola Ahmed Tinubu removed Mele Kyari and Pius Akinyelure as Group CEO and Chairman of NNPCL, respectively.

They were replaced with Bayo Ojulari as CEO and Ahmadu Musa Kida as Chairman appointments widely viewed as part of the government’s push to realign the oil sector with its economic revival agenda.