The Nigerian National Petroleum Company Limited is in talks for another oil-backed loan to boost its finances and allow investment in its business, the Group Chief Executive Officer, NNPCL, Mele Kyari, has said.

Sources familiar with the situation said the oil firm aims to raise at least $2bn through the proposed new loan.

In August 2023, NNPCL announced that it had secured a $3.3bn emergency crude oil repayment loan from the African Export-Import Bank.

When the $3.3bn loan is added to the newly proposed loan of $2bn, it means the national oil company is about raising its crude-backed loans to $5.3bn.

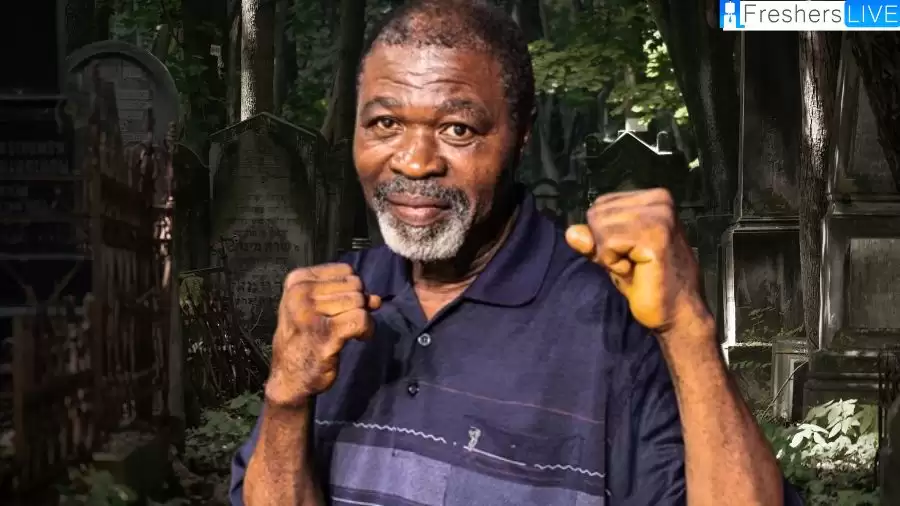

Kyari said the company wanted the new loan against 30,000-35,000 barrels per day of crude production, though he declined to say how much money it sought, Reuters reported on Tuesday.

This came as the queues for Premium Motor Spirit, popularly called petrol, persisted on Tuesday in Abuja and neighbouring states, as well as in Lagos, Nigeria’s commercial city.

Marketers blamed this on the shortage of supply by NNPCL, the sole importer of PMS into Nigeria. Other dealers stopped importing the commodity due to their inability to access the United States dollars.

Marketers also advised NNPCL to mindful with the collection of crude-backed loans, as they expressed hope that the situation would not become detrimental to Nigeria’s oil sector.