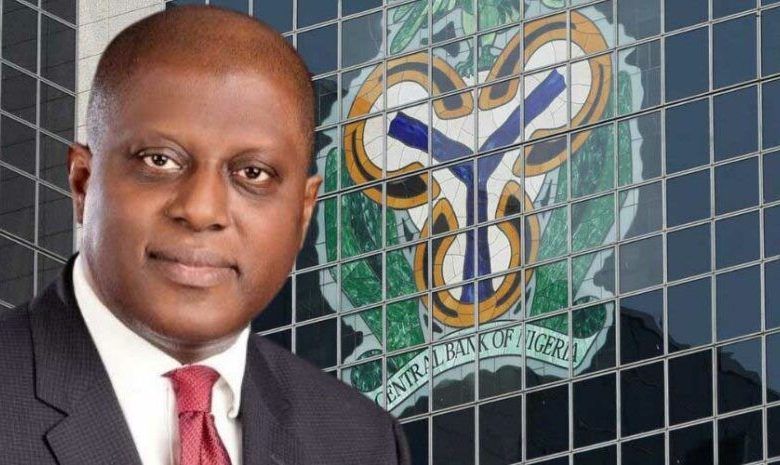

The Governor of the Central Bank of Nigeria Olayemi Cardoso says Nigeria is contemplating the issuance of a diaspora bond in the United States next year, aiming to secure monthly remittance inflows of $1 billion.

In an interview conducted during the International Monetary Fund (IMF) and World Bank meetings in Washington, D.C., Cardoso highlighted the growing investment appetite among Nigerians living abroad, who have doubled their remittance contributions since the current administration initiated significant reforms last year.

According to him, the proposed diaspora bond, which would target the United States—home to the largest population of overseas Nigerians—could emerge as a crucial financial instrument for the Nigerian government.

The Central Bank intends to remain vigilant in monitoring inflation and will allow economic indicators to guide interest rate decisions. Cardoso emphasized the importance of policy consistency in attracting long-term foreign investment, acknowledging that investors are still in the process of assessing the evolving economic environment. “Only time can show that you can stay the course,” he remarked.

Engagements with investors, rating agencies, and the diaspora have yielded a sense of validation for the government’s reform agenda. Cardoso underscored the necessity for Nigerians at home, who have borne the brunt of these changes, to understand that the country is on a promising path forward.