NVIDIA Results Sends Shockwaves Through the U.S. Equity Options Market

The anticipation surrounding Nvidia’s upcoming earnings report has sent shockwaves through the U.S. equity options market, with traders expecting a monumental $300 billion swing in the company’s shares.

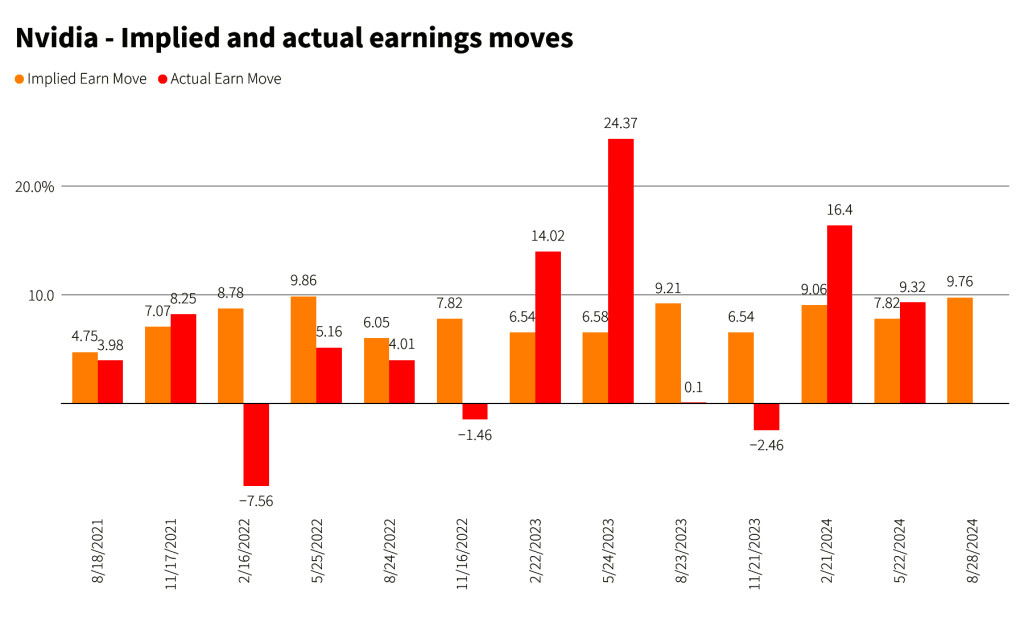

According to data from analytics firm ORATS, options pricing suggests a potential 9.8% move in Nvidia’s shares following its earnings report on Thursday, which would result in a staggering $305 billion shift in market capitalization.

Analysts believe that such a substantial swing in Nvidia’s shares could make history as the largest expected earnings move for any company to date. With a market capitalization of around $3.11 trillion, this anticipated change would surpass the market value of 95% of S&P 500 constituents, including industry giants like Netflix and Merck.

The significance of Nvidia’s results extends far beyond its stock performance; it also holds tremendous implications for the broader market. As one of the driving forces behind the S&P 500’s remarkable year-to-date gain, up approximately 18%, Nvidia has been pivotal in bolstering overall profitability.

Steve Sosnick, chief strategist at Interactive Brokers, emphasized Nvidia’s influential role within the market by stating that it “alone has been a huge contributor to the overall profitability of the S&P 500.” Describing it as “the Atlas holding up the market,” Sosnick underscored just how crucial Nvidia is to sustaining current levels of success.

Options pricing indicates that traders are primarily focused on seizing any potential upside from Nvidia rather than being overly concerned about downside risk. Susquehanna Financial analysis revealed that traders are assigning a mere 4% probability to an over-20% sell-off compared to a more significant 7% chance for an over-20% surge in share value by Friday following the earnings release.

The pervasive sentiment among traders appears to be one driven by “fear of missing out” (FOMO), prompting them to pursue insurance against missing out on possible gains rather than protecting against losses ahead of earnings reports.

This heightened level of anticipation can be attributed partly to previous volatility exhibited by Nvidia’s stock and its standing as an industry leader in artificial intelligence technology. The widespread recognition and prestige associated with its chips have solidified expectations for significant movements post-earnings reports.

As we approach this pivotal juncture for one of Silicon Valley’s most influential entities, all eyes will undoubtedly be on NVDA – with immense ramifications not only within tech circles but across broader financial markets.