President Bola Tinubu is set to revolutionize Nigeria’s revenue collection system by proposing the establishment of a single agency, the Nigeria Revenue Service, to handle all government revenue operations.

This initiative comes amid ongoing efforts to implement comprehensive tax reforms aimed at significantly boosting the country’s revenue collection.

Under the proposed reforms, revenue-generating agencies including the Nigerian Customs Service, Nigerian Ports Authority, and over 60 others would be barred from collecting revenues on behalf of the Nigerian Government. Instead, their revenue collection functions would be transferred to the newly formed Nigeria Revenue Service, which is intended to streamline tax collection and ensure that all taxable entities contribute fairly to support public services and infrastructure development.

The President submitted four executive bills to the National Assembly, including a bill to rename the Federal Inland Revenue Service (FIRS) to the Nigeria Revenue Service.

However, a Presidency source clarified that this is not a merger of agencies; rather, it is aimed at reallocating the revenue collection roles to the new agency while allowing existing agencies to focus on their core mandates, such as trade facilitation.

The proposed legislation, titled the Nigeria Revenue Service (Establishment) Bill, seeks to repeal the Federal Inland Revenue Service (Establishment) Act of 2007 and create the new agency tasked with assessing, collecting, and accounting for government revenues.

Alongside this bill, Tinubu introduced three additional tax reform proposals to enhance fiscal policy and streamline tax administration.

Among these is the Nigeria Tax Administration Bill, which aims to provide a clear legal framework for tax laws, facilitating compliance and reducing disputes. The Joint Revenue Board Establishment Bill is designed to create a Tax Tribunal and Tax Ombudsman to harmonize and coordinate revenue administration.

Tinubu emphasized that these proposed reforms are crucial for promoting taxpayer compliance, strengthening fiscal institutions, and fostering a transparent fiscal regime. He expressed confidence that, once passed, these bills would stimulate economic growth, boost consumer spending, and encourage investment in Nigeria.

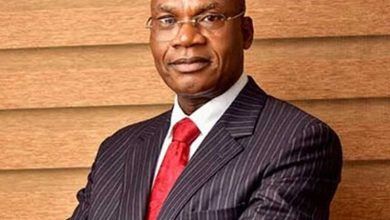

Speaker of the House of Representatives, Tajudeen Abbas, confirmed receipt of the bills and noted their alignment with the administration’s objectives to support economic sustainability. He urged the Committee on Rules and Business to schedule a debate on the proposed legislation.

The proposed reforms follow recommendations from Taiwo Oyedele’s Presidential Fiscal Policy and Tax Reforms Committee, which seeks to reduce the tax burden in Nigeria significantly.

The initiative aligns with the Tinubu Policy Advisory Council’s call for a state of emergency on revenue generation to address the country’s fiscal challenges and improve its tax-to-GDP ratio, which currently lags behind the African average.