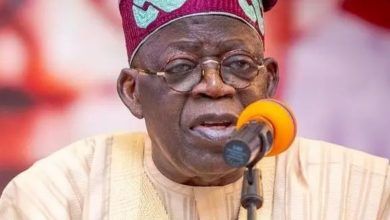

The House of Representatives has passed the four tax reform bills that were transmitted to the National Assembly by President Bola Tinubu in October 2024. Last Thursday, the House considered and approved the report from the House Committee on Finance, which included recommendations on several contentious issues, such as the Value Added Tax and inheritance tax.

While awaiting passage by the Senate, the proposed reforms are expected to be forwarded to the President for his assent in the coming days. The bills include: the Nigeria Tax Administration Bill (HB.1756), the Nigeria Revenue Service (Establishment Bill) (HB.1757), the Joint Revenue Board Bill (HB.1758), and the Nigeria Tax Bill (HB.1759).

The bills have sparked significant controversy and skepticism among various groups, individuals, and regions across the country. In response, extensive consultations and discussions were held at different levels, culminating in a public hearing designed to gather and consider a broad range of opinions.

As a result, the bills were refined during the legislative process, with amendments, deletions, and the introduction of new sections and subsections by the House Committee on Finance, which were later adopted and passed through the third reading.