The Senate has rejected a bill that sought to abolish the Foreign Exchange (Monitoring and Miscellaneous Provisions) Act, 2004, (which is already a duty of the Central Bank of Nigeria) and establish a Foreign Exchange Market in Nigeria.

The bill, read for the first time in February 2024 and sponsored by Senator Mohammed Sani representing Niger East, aims to make provisions for the control, monitoring and supervision of transactions conducted in the Foreign Exchange Market.

Musa said in his lead debate that the measure does not intend to establish any agency or commission that may require government money.

The bill, when passed into law, is expected to contribute to sound development of the nation’s economy, facilitate foreign transactions as well as stabilise the value of the naira by ensuring the liberalisation of foreign transactions.

Clause 6 of the bill introduces New Sub-clauses (2), (4) and (5) which require authorised dealers to render returns to the CBN on sources of foreign exchange in excess of 10,000 US dollars, utilisation of same, and obtain prior approval of the CBN when seeking to import foreign currency notes.

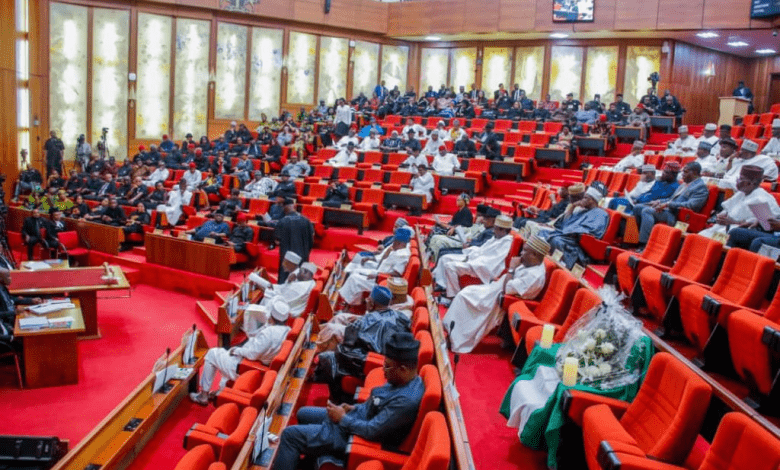

While some lawmakers supported the measure, others advocated for more study of the inherent features, which some have described as unclear.

The Senators voiced concern about the immediate impact that passage of the measure into second reading will have on the foreign market and the naira.

When put to a voice vote, the bill was rejected.