The Central Bank of Nigeria (CBN) has been advised to refrain from intervening in the foreign exchange market through forex auctions and to reinforce its commitment to exchange rate flexibility.

This policy recommendation, issued by the World Bank in its Nigeria Development Update, aims to stabilize the naira against foreign currencies.

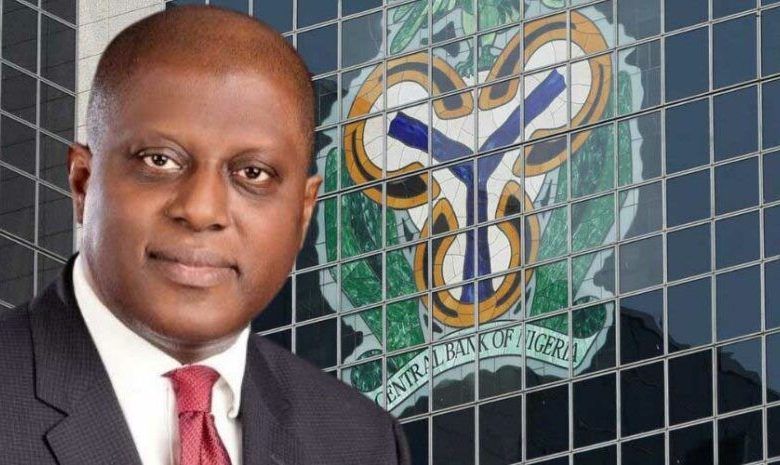

On August 26, 2024, the CBN auctioned $876.26 million to end users via a retail Dutch auction, marking a significant shift from its previous practice of selling foreign exchange to Bureau De Change operators. This intervention, led by CBN Governor Yemi Cardoso, is part of ongoing efforts to address volatility in the FX market.

The CBN stated that the auction process is intended to enhance foreign exchange liquidity, alleviate demand pressure, and support price discovery. A total of 3,347 firms accessed dollars through 26 banks at a cut-off rate of N1,495 per dollar.

However, the World Bank report emphasized the importance of allowing market participants greater flexibility in trading FX over time to deepen the FX market. It suggested that exchange rate policy should focus on maintaining a unified, market-reflective exchange rate and recommended several measures, including: Facilitating formal remittance inflows, Allowing international oil companies to concentrate their FX sales in the official market, Restoring access for Bureau De Change operators and Avoiding ad-hoc FX auctions.

The report emphasized the need for strategic efforts to build foreign reserves, which would help determine the fair value of the naira and create a stable economic environment conducive to both domestic and international trade. The World Bank underscored that a flexible exchange rate framework would anchor expectations to economic fundamentals rather than perceived target levels, ultimately supporting fiscal revenues and attracting investment.

Despite the recommendations, it remains uncertain whether the CBN will implement these changes. At a recent IMF/World Bank meeting in Washington, D.C., Nigeria’s Minister of Finance Wale Edun acknowledged that the government does not always adopt the policy recommendations from international agencies, even while valuing their insights.

In addition, the World Bank highlighted a troubling increase in non-performing loans (NPLs) across Nigerian banks, which rose to 5.1% in Q1 2024, slightly above the prudential benchmark. This increase is attributed to high inflation, naira depreciation, and the erosion of the banking system’s capital buffers, which fell from 14.2% in Q1 2023 to 11.1% in Q1 2024.

The report also noted that large open market operations by the CBN have significantly drained naira liquidity, with over N6.6 trillion conducted in the first eight months of 2024 30% more than the total in the preceding three years.

This monetary policy tightening has begun to anchor market rates to the Monetary Policy Rate (MPR) and has attracted FX inflows, contributing to the ongoing reforms in the foreign exchange market.